Steps to Mitigate Social Inflation

“Social inflation” — the increased cost of litigation above general economic inflation — has had a significant impact over the past five to six years, drastically increasing the cost of claims.

The main factors driving social inflation are:

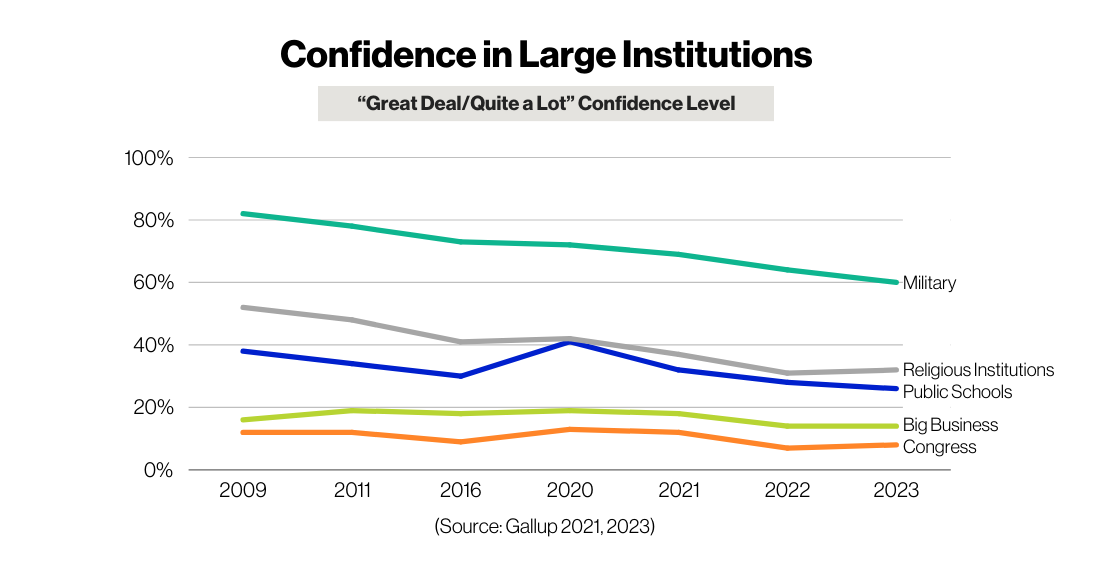

- Mistrust in institutions

- A challenging litigation environment

- Increased legislative risk, such as reviver statutes

Public confidence has declined in education and other big institutions. Juries, which are likely to be biased against institutions and their insurers, award large verdicts, either to punish the institution or due to the belief that the institution can afford it.

Higher education specifically has seen a decline in confidence from 57% in 2015 to 36% in 2023 (Gallup 2023).

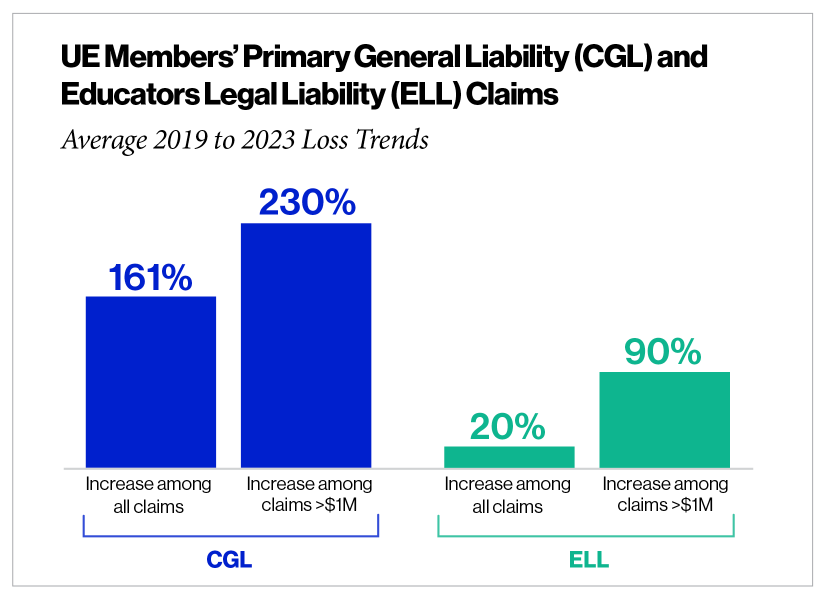

Claims defense and settlement costs continue to rise for K-12 schools, colleges, and universities. United Educators (UE) members are facing increased severity of claims of all types. Social inflation and increased settlements affect all UE members.

Sexual misconduct claims are of particular concern, comprising nearly 44% of total incurred general liability losses between 2019 and 2023. Even excluding employment-related harassment and high-profile claims related to serial abusers, UE saw sexual misconduct claims grow three times faster than all other claim types over the last 15 years.

There are geographic differences in litigation environments, but these factors are driving up costs everywhere.

Litigation advertising is an emerging issue. Trial lawyers spend large sums of money on advertising, touting successes and recruiting new clients for class action lawsuits. An estimated $1.2 billion was spent in 2023 on TV ads by lawyers and others seeking clients or offering legal services. The barrage of 45,000 TV ads airing everyday nationwide gives jurors a false impression of the value of most claims and desensitizes them to large-dollar verdicts.

Third-party litigation financing is when investors feed money into lawsuits where they don’t have a stake in the claim. They seek a percentage of the settlement or judgment. Funders, including foreign investors, are supporting their interests, rather than the victims’. In 2023, the U.S. Chamber of Commerce Institute for Legal Reform said third-party litigation financing “has experienced explosive growth and is now a multibillion-dollar industry worldwide, with an estimated $13 billion in assets under management in the United States alone.”

The Reptile Theory trial strategy is when plaintiff attorneys focus on underlying safety or security issues in a way that appeals to the jury’s survival instincts. This approach plays on the idea of large institutions as bad actors and attacks people as uncaring.

State reviver statutes provide an extended time frame for claims to be filed many years after incidents occur. Claims can be brought long after policies were written, and so attenuated from the incident that memories have faded, and records have been lost.

Take These Steps to Help Protect Your Institution

UE and our members must work as partners in addressing the rising cost of claims. Together, we can take steps to help stay ahead of emerging risks and to respond thoughtfully when incidents occur. Here’s how.

Invest in Planning

Create a culture of risk management

You play a critical role fostering a risk management mindset across your campus, even if you don’t have a formal enterprise risk management (ERM) program. This means a comprehensive approach that includes working to help prevent risks, building your tower of insurance coverage, following your risk management policies and procedures, and partnering with us on claims resolution.

Draw upon our library of education-specific risk management resources, online learning, claims studies, and webinars, as well as our risk advisors, to help you plan ERM efforts. Our consultants can provide personalized guidance, and our workshops can help you start an ERM program.

Collaborate with us on top risks

Risk management has never been more important as a set of actions institutions can take to prevent incidents or reduce the severity of those incidents that can’t be prevented.

With a singular focus on education and decades of claims experience, we have a deep engagement with our members and are committed to helping address your top risk concerns while intensifying our focus on risks resulting in high losses.

K-12 and higher education institutions indicated, in many instances, an overlap of our members’ top risk concerns and risks resulting in high financial losses.

Consider options for premium credits

We understand the value of having more control over your insurance costs and budget planning. Here are risk transfer approaches you can explore to help manage costs.

Our Risk Management Premium Credit (RMPC) program encourages you to start a risk mitigation activity during your policy term. You can earn a premium credit of up to 6% upon renewal. Participating members are required to address risks that drive common or significant losses related to a policy placed with UE.

Mitigation activities include conducting training, audits, policy review and development, and tabletop exercises, and risk management practices on high-loss topics such as workplace discrimination, sexual harassment, slips and falls, transportation, sexual misconduct, and risk transfer contracting.

Increasing self-insured retentions or deductibles can be a means of helping stabilize premiums and drive greater risk management focus on your campus. Members of all sizes are choosing to take this approach. Some charge back a portion of the deductible or self-insured retention to individual departments or programs to encourage good risk management across campus.

Prepare to Respond

Ready your crisis response

Our claims experience shows that an institution’s responses when bad things happen can seriously impact the likelihood and value of claims. A well-executed response by your school that considers all those impacted by a traumatic event can convey your community is caring and promote healing.

Keeping a cool head by following policies and protecting your institution, while also using a warm heart to bring compassion and empathy to the injured party is part of sound risk management.

We can help you increase readiness to manage a range of crises on and off campus. Our crisis response tabletop exercises help you assess response efforts in advance of a crisis, identify flaws or gaps in campus’ responses, and adjust as needed. In the event of a tragedy or crisis, our supplemental crisis response program, ProResponse® (available to eligible members), provides expert guidance to help your community recover.

Follow through on your procedures

Periodically review campus risk management practices to ensure your policies are being followed. Where policies are not followed, either evaluate and modify the policy as appropriate so it fits campus risk management practices or modify your practices so they support and enforce appropriate risk management policies.

Engage UE education claims professionals

One of your many member benefits is the support from our Resolutions team’s unique experience handling education claims. Our Cool Head, Warm Heart® philosophy means we bring a thoughtful, compassionate response to handling claims. At a time when the overall cost of claims — settlements, verdicts, and defense costs — are rising, UE strives to drive down loss experience.

Our expert Resolutions professionals focus solely on education claims, working collaboratively with defense counsel and your institution to help achieve the best result for all involved.

Recognizing that prolonged disputes demand resources from all parties, we craft strategies to explore early resolution without litigation and work collaboratively to develop good legal outcomes.

Remember the benefits of early reporting

Our members with educators legal liability (ELL) policies can receive pre-claim advice credit for early consultation with legal counsel on qualifying ELL circumstances. This is an opportunity to take advantage of our claims management expertise, including strategies to reduce the likelihood of claims.

We draw upon data analytics to help manage risks, mitigate claims, and avoid possible retaliation. Our jurisdictional knowledge and experienced defense counsel are essential to effective claims resolution. Our cost-effective approach includes using litigation management tools, case assessments, guidance on preparing proper documentation, early budget forecasting, and candid feedback.

Partner with UE

UE has spent nearly 40 years partnering with our member-owners. We remain committed to helping you grow robust and comprehensive risk management policies and programs. Our goal is to help you keep our communities safe, by providing practical risk management tools and learning opportunities, offering essential coverage you need, and resolving claims effectively.

Our partnership includes staying on top of current and developing trends and emerging risks and understanding how they might impact you.

Strengthening your partnership with UE will better help you manage risk. To learn more about steps you can take to mitigate social inflation, contact risk@ue.org.

More From UE

[Video] Social Inflation: What It Is and Why It Matters

Actionable Insights: Partnering With UE in Your Incident Response (Higher Ed)

Actionable Insights: Partnering With UE in Your Incident Response (K-12)

Rising Costs of Claims: By the Numbers

Rising Cost of Claims: Independent and Charter School Insights

Additional Resources

The Institutes: Social Inflation — Evidence and Impact on Property-Casualty Insurance